190 CARONDELET PLAZA, SUITE 1530, CLAYTON, MISSOURI 63105 USA Dear Olin

Corporation (Olin) Shareholder:

We cordially invite you to attend our

20182023 annual meeting of shareholders

(annual meeting) on April

26, 2018.27, 2023.

This booklet includes the notice of

the annual meeting

of shareholders and proxy statement, which

describesdescribe the business we will conduct at the

annual meeting and provides information about Olin that you should consider when you vote your shares. We have not planned a communications segment or any presentations for the

20182023 annual meeting.

Whether or not you plan to attend, it is important that your shares are represented and voted at the annual meeting. If you do not plan to attend the annual meeting, you may vote your shares

on the Internet,online, by telephone or

if you received paper copies of our proxy materials by completing,

signing and dating and returning

thea proxy card in the

enclosed envelope. Ifpostage paid envelope provided. Even if you plan

to attendon attending the annual meeting

in person, we encourage you

will need to

bring the upper half ofvote your shares by submitting your proxy

card to use as your admission ticket forin advance of the

annual meeting.

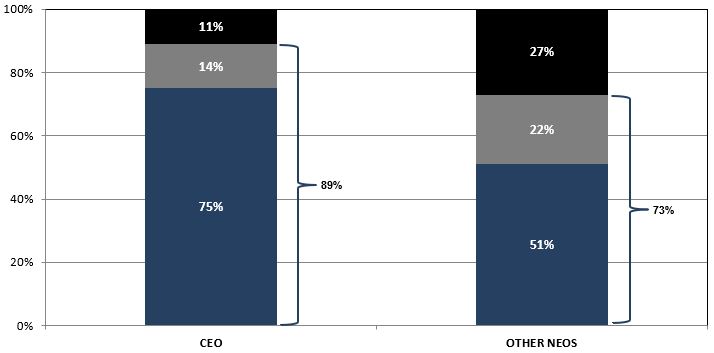

At last year’s annual meeting more than

95%89% of our shares were represented in person or by proxy. We hope for the same high level of representation at this year’s meeting and we urge you to vote as soon as possible.

| | |

Sincerely, |

|

| Scott Sutton |

| Chairman, President and Chief Executive Officer |

|

|

| |

John E. Fischer |

Chairman, PresidentYOUR VOTE IS IMPORTANT

We urge you to promptly vote your shares online, by telephone or by completing, signing and

Chief Executive Officer

dating and returning a proxy card in the postage prepaid envelope. |

YOUR VOTE IS IMPORTANT

We urge you to promptly vote the shares on the Internet,

by telephone or by completing and returning

your proxy card in the enclosed envelope.

Notice of Annual Meeting of Shareholders

| | | | | |

| Time: | | 8:00 a.m. (Central Daylight Time) |

| |

| Date: | | Thursday, April 26, 2018 27, 2023 |

| |

| Place: | | Plaza in Clayton Office Tower |

| | 190 Carondelet Plaza |

| | Annex Room - 16thRoom—16th Floor |

| | Clayton, MO 63105 USA |

| |

| Purpose: | | To consider and act upon the following: |

| |

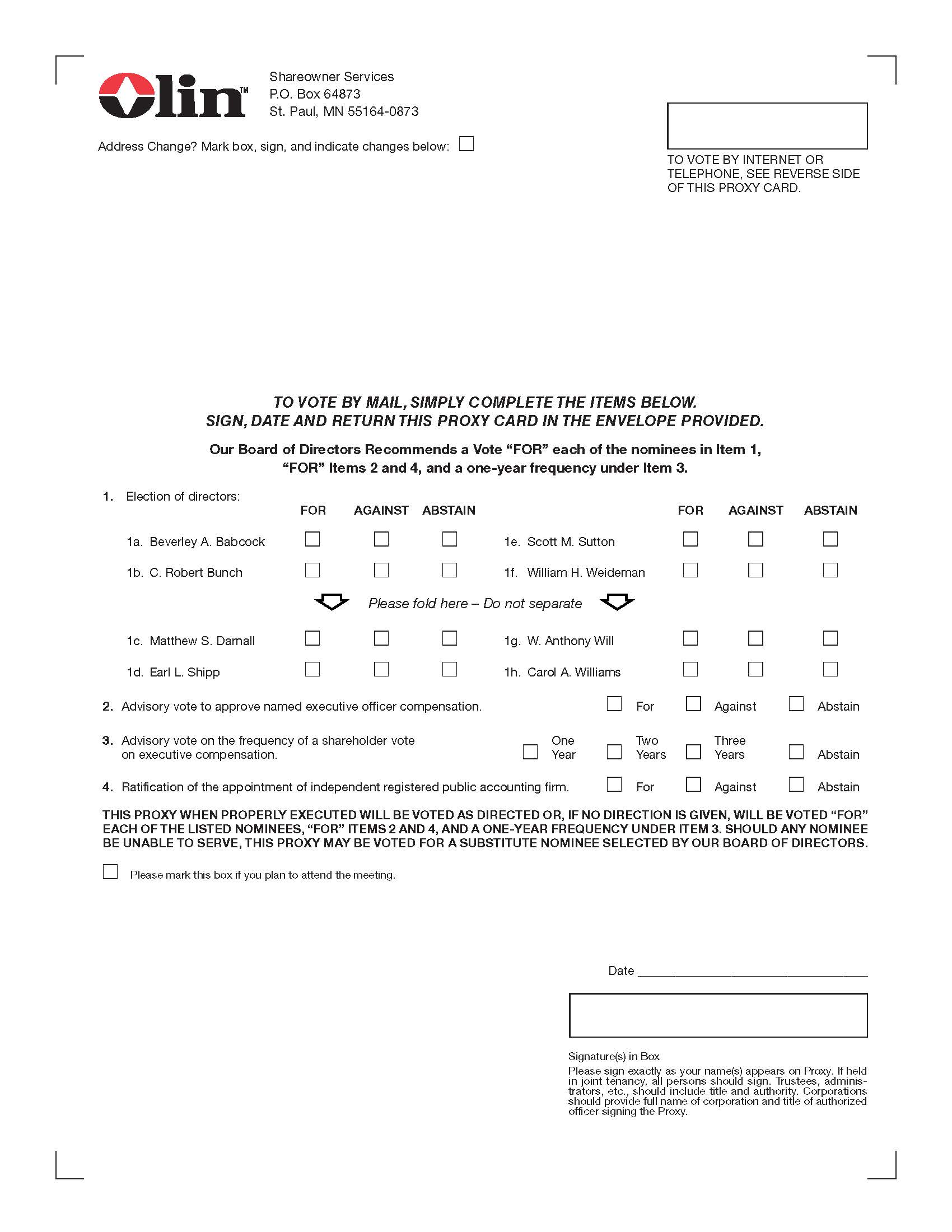

| | (1)Election of one director to serve for atwo-year term expiring in 2020 and election of threeeight directors, to serve for three-year terms expiring in 2021, all of whom are identified in the proxy statement.

|

| |

| | (2) Approval of the Olin Corporation 2018 Long Term Incentive Plan.

|

| |

| | (3) Conduct an advisory vote to approve the compensation for named executive officers.

|

| (3) Conduct an advisory vote on the frequency of a shareholder vote on executive compensation. |

| | (4) Ratification of the appointment of the independent registered public accounting firm for 2018.2023.

|

| |

| | (5) Such other business that is properly presented at the meeting.

|

| |

Who May Vote: | | You may vote if you were thea record owner of Olin common stock at the close of business on February 28, 2018. 27, 2023. |

| | |

By Order of theour Board of Directors: |

|

|

|

Eric A. BlanchardDana C. O’Brien |

| Secretary |

March 12, 201817, 2023

____________________

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To be Held on April 26, 2018

____________________

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS FOR THE

2023 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL

26, 201827, 2023

Olin’s Notice of 2023 Annual Meeting of Shareholders and Proxy Statement and 20172022 Annual Report onForm 10-K are available atwww.proxydocs.com/olnwww.olin.com/proxy. You will need your11-digit control number located in the upper right box on the front of your proxy card or the notice regarding the availability of proxy materials to vote your shares.

Why did I receive a notice in the mail regarding the availability of proxy materials instead of printed copies of the proxy materials?

In accordance with rules adopted by the U.S. Securities and Exchange Commission (SEC), we may furnish proxy materials to

ourthe shareholders by providing access to these documents

on the Internetonline instead of mailing printed copies. Unless you are a participant in the Olin Corporation Contributing Employee Ownership Plan

(the CEOP)(CEOP), you will not receive printed copies of the materials unless you request them. Instead, we mailed you the notice regarding the availability of proxy materials

(notice) (unless you have previously consented to electronic delivery or already requested to receive printed copies), which describes how you may access and review all of the proxy materials

on the Internet.online. The notice regarding the availability of proxy materials provides instructions as to how shareholders can access the proxy materials online, contains a listing of matters to be considered at the meeting, and sets forth instructions as to how shares can be voted. Shares must be voted either

on the Internet,in person, online, by telephone, or by completing and returning a proxy card. Shares cannot be voted by marking, writing on and/or returning the notice regarding the availability of proxy materials. Any notices regarding the availability of proxy materials that are returned will not be counted as votes. Instructions for requesting a paper copy of the proxy materials are

set forthincluded on the notice regarding the availability of proxy materials.

This process is designed to expedite shareholders’ receipt of proxy materials, lower the cost of the annual meeting, and help conserve natural resources. However, if you prefer to receive printed proxy materials via mail or receive an e-mail with links to the electronic materials, please follow the instructions included on the notice regarding the availability of proxy materials.

Why did I receive this proxy statement?

You received this proxy statement because you owned shares of Olin common stock,

$1 par value

$1 per share, which we sometimes refer to as common stock

or shares, at the close of business on February

28, 2018.27, 2023. Olin’s

boardBoard of

directorsDirectors (Board) is asking you to vote at the

20182023 annual meeting FOR each of

theour director nominees identified in Item 1,

and FOR Items 2

3 and 4

and FOR a one-year frequency for Item 3 listed in the notice of the annual meeting of shareholders. This proxy statement describes the matters on which we would like you to vote and provides information so that you can make an informed decision.

When was the notice regarding the availability of proxy materials distributed to shareholders?

We began to distribute the notice regarding the availability of proxy materials to shareholders via mail and email on or about March 17, 2023.

When was this proxy material mailed to shareholders? We began to mail the proxy statement and form of proxy to shareholders on or about March 12, 2018.17, 2023.

When was the notice regarding the availability of proxy materials mailed to shareholders?

We began to mail the notice regarding the availability of proxy materials to shareholders on or about March 12, 2018.

What if I have questions?

If you have questions, please write them down and send them to the

Office of the Secretary at

Olin’s principal executive office atOlin Corporation, 190 Carondelet Plaza, Suite 1530, Clayton, MO 63105 USA.

What will I be voting on?

You will be voting on:

| 1. | the election of the four directors identified in the proxy statement;

|

| 2. | the approval of the Olin Corporation 2018 Long Term Incentive Plan;

|

| 3. | an advisory vote to approve the compensation for named executive officers;

|

| 4. | the ratification of KPMG LLP (KPMG) as Olin’s independent registered public accounting firm for 2018; and

|

| 5. | any other business properly presented at the annual meeting.

|

The proposal to ratify

(1)the appointmentelection of KPMG as Olin’s independent registered public accounting firm for 2018 is considered a discretionary item for which a broker will have discretionary voting power if you do not give instructions with respect toeight directors identified in this proposal. The proposals to elect directors, to approve the Olin Corporation 2018 Long Term Incentive Plan and to conduct proxy statement;

(2)an advisory vote to approve the compensation for named executive officers arenon-routine matters for which a broker will not have discretionary voting power and for which specific instructions from beneficial owners are required. As a result, a broker will not be allowed to(NEOs);

(3)an advisory vote on these three matters on behalfthe frequency of its beneficial owner customers if the customers do not return specific voting instructions. If you are a shareholder that holds shares through a broker, please provide specific voting instructions to your broker.vote on executive compensation;

(4)the ratification of the appointment of KPMG LLP (KPMG) as Olin’s independent registered public accounting firm for 2023; and

(5)any other business properly presented at the annual meeting.

Could other matters be voted on at the annual meeting?

As of March

12, 2018,17, 2023, the items listed in the preceding question are the only matters being considered. If any other matters are properly presented for action, the persons

named in the accompanying form of proxyacting as proxies will vote

theeach proxy in accordance with their good faith business judgment as to what is in the best interests of Olin.

How does

the boardour Board recommend I vote on the proposals?

Our

boardBoard recommends a vote FOR each of the director nominees identified in Item 1,

and FOR Items 2

3 and

4.4 and FOR a one-year frequency under Item 3.

What is a broker non-vote?

A broker non-vote occurs when brokers, banks or other nominees holding shares for a beneficial owner have discretionary authority to vote on “routine” matters brought before a shareholder meeting, but the beneficial owner of the shares fails to provide the broker, bank or other nominee with specific instructions on how to vote on any “non-routine” matters brought to a vote at the shareholders meeting.

Brokers, banks and other nominees will be entitled to vote your shares on “routine” matters without instructions from you. The only proposal that would be considered “routine” in such event is the proposal for the ratification of the appointment of KPMG as Olin’s independent registered public accounting firm. A broker, bank or other nominee will not be entitled to vote your shares on any “non-routine” matters, absent instructions from you. “Non-routine” matters include the election of directors, the approval, on a non-binding advisory basis, of the compensation paid to Olin’s NEOs and the non-binding advisory vote on the frequency of a shareholder vote on executive compensation. If you are a shareholder that holds shares through an account with a broker, bank or other nominee, please provide specific voting instructions to your broker, bank or other nominee.

Consequently, if you do not submit any voting instructions to your broker, bank or other nominee, your broker, bank or other nominee may exercise its discretion to vote your shares only on the proposal to ratify the appointment of KPMG. If you do not direct your broker, bank or other nominee as to how your shares should be voted, your shares will constitute broker non-votes on each of the other proposals. Broker non-votes will count for purposes of determining whether a quorum exists, but will not be counted as votes cast with respect to such proposals.

What do I need to do to attend the

20182023 annual meeting in person?

Each attendee must bring a valid, government-issued photo ID, such as a driver’s license or passport, as well as otherand verification of Olin common stock ownership. For a shareholder of record (a shareholder with a stock certificate or participantwho holds shares in thean account with our transfer agent, EQ Shareowner Services) or CEOP participant, please bring your notice of the annual meeting or the upper half of your proxy card (CEOP shares must be voted either on the Internet or by telephone no later than 11:59 p.m. Central Daylight Time on April 22, 2018, or by mail ifreceived by April 20, 2018).card. If you are a beneficial owner of Olin common stock, but do not hold your

shares in your own namean account with a broker, bank or other nominee (i.e., your shares are held in street name), please bring the notice or voting instruction form you received from your broker, bank broker or other nominee. You may also bring your bankbrokerage or brokeragebank account statement reflecting your ownership of Olin common stock ownership as of February 28, 2018,27, 2023, the record date.

date for voting. If you hold your shares through a broker, bank or other nominee, you will not be permitted to vote at the meeting without obtaining a “legal proxy” from that nominee.

Please note that cameras, sound or video recording equipment,

cellular telephones, smartphonesmobile phones and other similar devices, as well as purses, briefcases, backpacks and packages, will not be allowed in the meeting room. No one will be admitted to the meeting once it begins.

How can I obtain directions to be able to attend the annual meeting and vote in person?

You may obtain directions to the Plaza in Clayton Office Tower in Clayton, MO, USA by contacting the Plaza in Clayton Office Towercalling 1-314-290-5039 or online at1-314-290-5039 or by accessing its website atwww.theplazainclaytonoffice.com/http://theplazainclayton.axisportal.com/Directions.axis.

All shareholders of record at the close of business on February

28, 2018,27, 2023, are entitled to vote at the annual meeting.

How many votes can be cast by all shareholders?

At the close of business on February 28, 2018,27, 2023, the record date for voting,the annual meeting, we had 167,192,875 130,869,243 outstanding shares of common stock. Each shareholder on the record date may cast one vote for each full share owned. The presence in person or by proxy of the holders of a majority of such outstanding shares constitutes a quorum. If a share is present for any purpose at the meeting, it is deemed to be present for the transaction of all business. Abstentions and shares held in street name (broker shares) that are voted on any matter will be included in determining the number of votes present. Shares held in street nameBroker shares that are not voted on any matter at the meeting will not be included in determining whether a quorum is present.

How do I

vote?vote if I am not the shareholder of record?

If you are not the shareholder of record but hold shares through an account with a broker, bank or other nominee, the broker, bank or other nominee may have special voting instructions that you should follow. Please see the materials sent to you by your broker, bank or other nominee for information on how to vote your shares.

How do I vote if I am the shareholder of record?

You may vote either in person at the annual meeting or by proxy. To vote by proxy, you must select one of the following options:

| · | | Vote on the Internet (Internet voting instructions are printed on the notice regarding the availability of proxy materials and/or your proxy card):

|

| · | | Accesswww.proxypush.com/oln.

|

| · | | Have the notice regarding the availability of proxy materials and/or your proxy card in hand.

|

| · | | Follow the instructions provided on the site.

|

| · | | Submit the electronic proxy before the required deadline (11:59 p.m. Central Daylight Time on April 25, 2018, for shareholders and 11:59 p.m. Central Daylight Time on April 22, 2018, for CEOP participants).

|

| · | | If you are not the shareholder of record but hold shares through a custodian, broker or other agent, such agent may have special voting instructions that you should follow.

|

| · | | Vote by telephone (telephone voting instructions are printed on the notice regarding the availability of proxy materials and/or your proxy card):

|

| · | | From the U.S. and Canada, call the toll-free voting telephone number:1-866-883-3382.

|

| · | | Have the notice regarding the availability of proxy materials and/or your proxy card in hand.

|

| · | | Follow and comply with the recorded instructions by the applicable deadline (11:59 p.m. Central Daylight Time on April 25, 2018, for shareholders and 11:59 p.m. Central Daylight Time on April 22, 2018, for CEOP participants).

|

| · | | If you are not the shareholder of record but hold shares through a custodian, broker or other agent, such agent may have special voting instructions that you should follow.

|

| · | | Complete the enclosed proxy card:

|

| · | | Complete all of the required information on the proxy card.

|

| · | | Sign and date the proxy card.

|

| · | | Return the proxy card in the enclosed postage-paid envelope. We mustreceive the proxy card by April 25, 2018, for shareholders or by April 20, 2018, for CEOP participants, for your proxy to be valid and for your vote to count.

|

| · | | If you are not the shareholder of record but hold shares through a custodian, broker or other agent, such agent may have special voting instructions that you should follow.

|

•Vote online:

•Access the website listed in the proxy materials you received.

•Have the notice regarding the availability of proxy materials and/or your proxy card in hand.

•Follow the instructions provided on the website.

•Submit the electronic proxy before the required deadline (April 24, 2023 at 11:59 p.m. Eastern Time for CEOP participants and April 26, 2023 at 11:59 p.m. Eastern Time for all other shareholders).

•Vote by telephone:

•Call the numbers listed in the proxy materials you received.

•Have the notice regarding the availability of proxy materials and/or your proxy card in hand.

•Follow and comply with the recorded instructions by the applicable deadline (April 24, 2023 at 11:59 p.m. Eastern Time for CEOP participants and April 26, 2023 at 11:59 p.m. Eastern Time for all other shareholders).

•Vote by proxy card:

•Complete all of the required information on the proxy card.

•Sign and date the proxy card.

•Return the proxy card in the postage paid envelope provided. We must receive the proxy card no later than April 24, 2023 for CEOP participants or no later than April 26, 2023 for all other shareholders, for your vote to be counted.

If you vote in a timely manner

on the Internetonline or by telephone, you do not have to return the proxy card for your vote to count.

The Internet and telephone voting procedures appear in the upper right box of the notice regarding the availability of proxy materials or your proxy card. You may also log on to change your vote or to confirm that your vote has been properly recorded.If you want to vote in person at the

2023 annual meeting, and you own Olin common stock

throughin an account with a

custodian, broker,

bank or other

agent,nominee, you must obtain a

legal proxy from that party in their capacity as owner of record for your shares and bring the

legal proxy to the

2023 annual meeting.

Where can I access an electronic copy of the Proxy Statement and Annual Report on

Form 10-K for the year ended December 31,

2017?Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on April 26, 2018:

2022?

You may access an electronic, searchable copy of the 20182023 Proxy Statement and the Annual Report on Form 10 -K 10-K for the year ended December 31, 2017,2022, atwww.proxydocs.com/oln.

www.olin.com/proxy. If you specifically mark the proxy card (or vote on the Internetonline or by telephone) and indicate how you want your vote to be cast regarding any matter, your directions will be followed. If you sign and submit the proxy card but do not specifically mark it with your instructions as to how you want to vote, the proxy will be voted FOR the election of the directorsour director nominees named in Item 1, FOR Items 2 and 4, and FOR a one-year frequency under Item 3 listed in this proxy statement in Item 1, and FOR Items 2, 3 and 4 listed in the proxy.statement. If you submit a proxy card marked “abstain” on any item, other than Item 2, your shares will not be voted on that item so marked and your vote will not be included in

determining the number of votes cast on that matter. Abstentions on Item 2 will have the same effect as a vote against the proposal. Shares held in street nameBroker shares that are not voted in the election of directorsdirector nominees in Item 1 or on Items 2, 3 orand 4 will not be included in determining the number of votes cast on those matters.

As of the date of this proxy statement, our Board knows of no business other than that set forth above to be transacted at the annual meeting, but if other matters requiring a vote do arise, it is the intention of the persons acting as proxies to whom you are granting your proxy to vote in accordance with their good faith business judgment as to what is in the best interests of Olin on such matters.

EQ Shareowner Services tabulates the shareholder votes and provides an independent inspector of election as part of its services as our registrar and transfer agent.

Yes. WhetherIf you vote on the Internet, by telephone or submitare a shareholder of record, you can revoke a proxy cardor change your vote before the completion of voting at the meeting by:

•casting a new vote online or by telephone;

•submitting another written proxy with a later date;

•sending a written notice of the change in your voting instructions to the Office of the Secretary at Olin Corporation, 190 Carondelet Plaza, Suite 1530, Clayton, MO 63105 USA if received no later than April 24, 2023 for CEOP participants or no later than April 26, 2023 for all other shareholders; or

•revoking the grant of a previously submitted proxy and voting in person at the annual meeting. Please note that your attendance at the annual meeting itself will not revoke a proxy.

If your shares are held in street name, you

mayshould follow the instructions provided by your broker, bank or other nominee to revoke or change your

vote by: | · | | casting a new vote on the Internet or by telephone;

|

| · | | submitting another written proxy with a later date;

|

| · | | sending a written notice of the change in your voting instructions to the Secretary ifreceived by April 25, 2018, for shareholders and by April 20, 2018, for CEOP participants; or

|

| · | | revoking the grant of a previously submitted proxy and voting in person at the annual meeting. Please note that your attendance at the annual meeting itself will not revoke a proxy.

|

voting instructions.

Proxies submitted by shareholders through the Internetonline or by telephone will be counted in the vote only if they arereceived no later than April 26, 2023 by 11:59 p.m. Central Daylight Time on April 25, 2018.Eastern Time. Shares represented by proxies on the enclosedvoted using a proxy card will be counted in the vote only if wereceive your proxy card byno later than April 25, 2018.26, 2023. Proxies submitted by CEOP participants will be counted in the vote only if they arereceived through the Internet by mail, online or by telephone no later than April 24, 2023 by 11:59 p.m. Central Daylight Time on April 22, 2018 orreceivedby mail by April 20, 2018.Eastern Time.

How do I vote my shares held in the Olin Contributing Employee Ownership Plan?

On February 28, 2018, the27, 2023, our CEOP held 2,642,850 1,720,525 shares of our common stock. Voya Institutional Trust Company serves as the Trustee of theour CEOP. If you are a CEOP participant, you may instruct theour CEOP Trustee on how to vote shares of common stock credited to your CEOP account on the items of business listed on the proxy card by voting on the Internet,online, by telephone or by indicating your instructions on your proxy card and completing, signing and dating and returning it to us.the proxy card in the postage paid envelope provided. The Trustee will vote shares of common stock held in theour CEOP for which they donot receive voting instructions in the same manner proportionately as they vote the shares of common stock for which theydo receive instructions. In order for your instructions to be counted by the Trustee, your vote must be

received by the Trustee no later than April 24, 2023 at 11:59 p.m. Eastern Time. How do I vote my shares held in the Automatic Dividend Reinvestment Plan?

EQ Shareowner Services is our registrar and transfer agent and administers theour Automatic Dividend Reinvestment Plan. If you participate in our Automatic Dividend Reinvestment Plan, EQ Shareowner Services will vote any shares of common stock that it holds for you in accordance with your instructions indicated on the proxy card you complete, sign, date and return or the vote you make on the Internetonline or by telephone.telephone if received no later than April 26, 2023 at 11:59 p.m. Eastern Time. If you donot submit a proxy card for your shares of record or vote on the Internetonline or by telephone, EQ Shareowner Services willnot vote your dividend reinvestment shares.

Can I contact

boardBoard members directly?

Our

audit committeeAudit Committee has established the following methods for shareholders or other interested parties to communicate directly with

the boardour Board and/or its members.

| · | | Mail—Letters may be addressed to the board or to an individual board member as follows:

|

•Mail—Letters may be addressed to our Board or to an individual Board member as follows:

The Olin Board or (Name of the director)

c/o Office of the Secretary

190 Carondelet Plaza, Suite 1530

Clayton, MO 63105 USA

| · | | E-mail—You may send ane-mail message to Olin’s board at the following address:directors@olin.com. In addition, you may send ane-mail message to an individual board member by addressing thee-mail using the first initial of the director’s first name combined with his or her last name in front of@olin.com.

|

| · | | Telephone—Olin has established a safe and confidential process for reporting, investigating and resolving employee and other third party concerns. Shareholders or other interested parties may also use this Help-Line to communicate with one or more directors on any Olin matter. The Olin Help-Line is operated by an independent, third party service 24 hours a day, 7 days a week. In the United States and Canada, the Olin Help-Line can be reached by dialing toll-free1-800-362-8348. Callers outside the United States and Canada can find toll-free numbers for several countries available under “Dialing Options” atwww.OlinHelp.com or can reach the Olin Help-Line by calling the United States collect at1-770-810-1127.

|

•E-mail—You may send an e-mail message to Olin’s Board at the following address: odirectors@olin.com. In addition, you may send an e-mail message to an individual Board member by addressing the e-mail using the first initial of the director’s first name combined with his or her last name in front of @olin.com.

•Telephone—Olin has established a safe and confidential process for reporting, investigating and resolving employee and other third party concerns. Shareholders or other interested parties may also use this Help-Line to communicate with one or more directors on any Olin matter. The Olin Help-Line is operated by an independent, third party service 24 hours a day, 7 days a week. In the United States and Canada, the Olin Help-Line can be reached by dialing toll-free 800-362-8348. Callers outside the United States and Canada can find toll-free numbers for several countries available under “Dialing Options” at www.OlinHelp.com or can reach the Olin Help-Line by calling the United States collect at 770-810-1127.

Who pays for this proxy solicitation?

Olin will pay the entire expense of this proxy solicitation.

Who solicits the proxies and what is the cost of this proxy solicitation?

Our

boardBoard is soliciting the proxies on behalf of Olin.

We have engaged The Proxy Advisory Group, LLC (Proxy Advisory Group), a proxy solicitation firm, to assist in the solicitation of proxies and provide related advice and informational support, for a services fee and the reimbursement of customary disbursements, which are not expected to exceed $20,000 in total. In addition, Olin will reimburse brokers,

banks and other nominees for their expenses in forwarding proxy solicitation materials to holders.

How will the proxies be solicited?

Proxy Advisory Group will

Our directors, officers and employees may solicit proxies by personal interview, e-mail, mail and telephone, and

we will request brokerage houses and other custodians, brokers and other agents to forward proxy solicitation materials to the beneficial owners of Olin common stock for whom they hold shares.

Our directors, officers and employees may also solicit proxies by personal interview, e-mail and telephone.

How can I submit a shareholder proposal at the

20192024 annual meeting?

If you want to present a proposal for consideration at the 2024 annual meeting without including your proposal in the proxy statement, you must deliver a written notice containing the information required by Olin’s Bylaws to the Office of the Secretary at Olin Corporation, 190 Carondelet Plaza, Suite 1530, Clayton, MO 63105 USA no later than December 29, 2023, and also comply with other applicable requirements described in Olin’s Bylaws. You must also present your proposal in person at the 2024 annual meeting.

If you want to present a proposal to be considered for inclusion in the proxy statement for the 20192024 annual meeting, you must deliver the proposal in writing (and includea written notice containing the information required by Olin’s Bylaws)Bylaws to the Office of the Secretary at Olin Corporation, 190 Carondelet Plaza, Suite 1530, Clayton, MO 63105 USA no later than November 9, 2018. 18, 2023, and also comply with other applicable requirements described in Olin’s Bylaws, including the requirements under the SEC Rule 14a-8 . You must then present your proposal in person at the 20192024 annual meeting.

If you wantHow can I recommend a director for the slate of candidates to present a proposalbe nominated by Olin’s Board for considerationelection at the 20192024 annual meeting without including your proposalmeeting?

You can suggest that our Nominating and Governance Committee consider a person for inclusion in the proxy statement, you must deliverslate of candidates to be proposed by our Board for election at the 2024 annual meeting. A shareholder can recommend a person by delivering written notice (containingto the information required by Olin’s Bylaws) toOffice of the Secretary at Olin Corporation, 190 Carondelet Plaza, Suite 1530, Clayton, MO 63105 USA no later than January 25, 2019. You must also present your proposal in person at the 2019 annual meeting.How can I directly nominate a director for election to the board at the 2019 annual meeting?

According to Olin’s Bylaws, if you are a shareholder you may directly nominate an individual for election to the board if you deliver a written notice of the nomination to Olin’s Secretary no later than January 25, 2019. Your notice must include:

| · | | the name and address of the person you are nominating;

|

| · | | a statement that you are entitled to vote at the annual meeting (stating the number of shares you hold of record) and intend to appear at the annual meeting in person, or by proxy, to make the nomination;

|

| · | | a description of arrangements or understandings between you and others (and naming any such other persons), if any, pursuant to which you are making the nomination;

|

| · | | such other information about the nominee as would be required in a proxy statement filed under the SEC proxy rules; and

|

| · | | the written consent of the nominee to actually serve as a director, if elected.

|

Although a shareholder may directly nominate an individual for election as a director, the board is not required to include such nominee in the proxy statement.

How can I recommend a director for the slate of candidates to be nominated by Olin’s board for election at the 2019 annual meeting?

In addition to directly nominating an individual for election to the board as discussed above, you can suggest that our directors and corporate governance committee consider a person for inclusion in the slate of candidates to be proposed by the board for election at the 2019 annual meeting. A shareholder can recommend a person by delivering written notice to Olin’s board no later than October 12, 2018.19, 2023. The notice must include the information described under the heading “What Is Olin’s Director Nomination Process?” on page 20,

18, and must be sent to the address indicated under that heading. As noted above, the boardOur Board is not required to include such nominee in theour proxy statement.

How can I directly nominate a director for election to the Board at the 2024 annual meeting?

Our Bylaws set forth the procedures that a shareholder must follow to nominate a candidate for election as a director. You may directly nominate an individual for election to our Board at the 2024 annual meeting by delivering a written notice of the nomination containing the information required by Olin’s Bylaws to the Office of the Secretary at Olin Corporation, 190 Carondelet Plaza, Suite 1530, Clayton, MO 63105 USA no later than December 29, 2023, and also complying with the applicable requirements relating to the inclusion of shareholder nominees as described in Olin’s Bylaws, including the requirements under the SEC Rule 14a-19 and the delivery of a written notice that includes the proposing shareholder and nominee information, representations, undertakings and agreements.

How can I obtain shareholder information?

Shareholders may contact EQ Shareowner Services, our registrar and transfer agent, who also manages our Automatic Dividend Reinvestment Plan at:

1110 Centre Pointe Curve, Suite 101

Mendota Heights, MN 55120-4100 USA

Telephone:

1-800-401-1957Internet: 800-401-1957

Online: www.shareowneronline.com, click on “contact us.”

Shareholders can sign up for online account access through EQ Shareowner Services for fast, easy and secure access 24 hours a day, 7 days a week for future proxy materials, investment plan statements, tax documents and more. To sign up log on towww.shareowneronline.com wherestep-by-step instructions will prompt you through enrollment or you may call1-800-401-1957 800-401-1957 from the United States or1-651-450-4064 651-450-4064 from outside the United States for customer service.

How do you handle proxy materials for shareholders in the same household?

We are required to provide an annual report and proxy statement or notice of availability of these materials to all shareholders of record. If you have more than one account in your name or at the same address as other shareholders, Olin or your broker may discontinue mailings of multiple copies. If you received only one copy of this proxy statement and the annual report or notice of availability of these materials and wish to receive a separate copy for each shareholder at your household, or if, at any time, you wish to resume receiving separate proxy statements or annual reports or notices of availability, or if you are receiving multiple statements and reports and wish to receive only one, please notify your broker if your shares are held in a brokerage account or us if you hold registered shares. You can notify us by sending a written request to the Secretary at Olin Corporation, 190 Carondelet Plaza, Suite 1530, Clayton, MO 63105 USA or by calling 1-800-468-9716. If you request a separate copy of an annual report and proxy statement, they will be mailed to you promptly.

CERTAIN BENEFICIAL OWNERS

Except as listed below, to our knowledge, no person beneficially owned more than 5% of our common stock as of February 28, 2018. | | | | | | | | |

Name and Address of Beneficial Owner

| | Amount and

Nature of

Beneficial

Ownership

| | | Percent

of Class

| |

| | |

BlackRock, Inc. | | | 16,689,125 | (a) | | | 10.0 | % |

55 East 52nd Street | | | | | | | | |

New York, NY 10055 | | | | | | | | |

| | |

The Vanguard Group, Inc. | | | 14,602,134 | (b) | | | 8.8 | % |

100 Vanguard Boulevard | | | | | | | | |

Malvern, PA 19355 | | | | | | | | |

| | |

TIAA-CREF Investment Management, LLC | | | 9,853,573 | (c) | | | 5.9 | % |

Teachers Advisors, LLC | | | | | | | | |

730 Third Avenue | | | | | | | | |

New York, NY 10017 | | | | | | | | |

| | |

Iridian Asset Management LLC | | | 9,522,830 | (d) | | | 5.7 | % |

276 Post Road West | | | | | | | | |

Westport, CT 06880 | | | | | | | | |

| | |

Adage Capital Partners, L.P. | | | 9,021,489 | (e) | | | 5.4 | % |

200 Clarendon Street, 52nd Floor | | | | | | | | |

Boston, MA 02116 | | | | | | | | |

27, 2023. For each entity included in the table below, percentage ownership is calculated by dividing the number of shares reported as beneficially owned by such entity by the 130,869,243 shares of our common stock outstanding on February 27, 2023.(a) | Based on Amendment No. 10 to a Schedule 13G filing dated January 17, 2018, as

| | | | | | | | | | | | | |

Name and Address of December 31, 2017, BlackRock, Inc. had sole dispositive power over allBeneficial Owner | | Amount and Nature of the shares reported and sole voting power over 16,238,752 Beneficial Ownership | | Percent of such shares.Class |

(b) | Based on Amendment No. 5 to a Schedule 13G filing dated February 7, 2018, as of December 31, 2017,

| | | |

| FMR LLC | | 6,908,386 (a) | | 5.3% |

| 245 Summer Street | | | | |

| Boston, MA 02210 | | | | |

| | | | |

The Vanguard Group, Inc. had sole voting power over 87,795 shares, sole dispositive power over 14,497,927 shares, shared voting power over 29,157 shares and shared dispositive power over 104,207 shares. | | 14,729,968 (b) | | 11.3% |

100 Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of The Vanguard Group,Boulevard | | | | |

| Malvern, PA 19355 | | | | |

| | | | |

BlackRock, Inc., was the beneficial owner of 75,050 shares as a result of serving as investment manager of collective trust accounts, and Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of The Vanguard Group, Inc., was the beneficial owner of 41,902 shares as a result of serving as investment manager of Australian investment offerings. | | 13,291,247 (c) | | 10.2% |

(c)55 East 52nd Street | Based on Amendment No. 2 to a Schedule 13G filing dated February 14, 2018, as of December 31, 2017, TIAA-CREF Investment Management, LLC had sole voting and dispositive power over 7,608,017 of such shares and Teachers Advisors, LLC had sole voting and dispositive power over 2,245,556 of such shares. Each of TIAA-CREF Investment Management, LLC and Teachers Advisors, LLC. expressly disclaimed beneficial ownership of the other’s securities holdings and each disclaimed that it was a member of a group with the other.

| | | |

(d)New York, NY 10055 | Based on Amendment No. 1 to a Schedule 13G filing dated February 6, 2018, as of December 31, 2017, all such shares were beneficially owned by Iridian Asset Management, LLC (Iridian) and David H. Cohen and Harold J. Levy also may be deemed to beneficially own such shares by virtue of their indirect ownership and control of Iridian but disclaim beneficial ownership of such shares. The Schedule 13G reported that (i) Mr. Cohen had sole voting and dispositive power over 2,155 shares not included above and (ii) Mr. Levy had sole voting and dispositive power over 1,070 shares not included above.

| | | |

(e) | Based on Amendment No. 2 to a Schedule 13G filing dated February 13, 2018, as of December 31, 2017, Adage Capital Partners, L.P. held shared voting and shared dispositive power over all of the reported shares with Adage Capital Partners GP, L.L.C., Adage Capital Advisors, L.L.C., Robert Atchinson and Phillip Gross.

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

(a)Based on Schedule 13G filed February 9, 2023, as of December 30, 2022.

(b)Based on Amendment No. 11 to a Schedule 13G filed February 9, 2023, as of December 30, 2022.

(c)Based on Amendment No. 17 to a Schedule 13G filed February 9, 2023, as of January 31, 2023.

ITEM 1—PROPOSAL FOR THE ELECTION OF DIRECTORS

Who are the individuals nominated by

the boardour Board to serve as directors?

The board of directors is divided into three classes.

Each class hasdirector nominee will be elected annually for a one-year term of office for three years, and the term of each class ends in a different year. In 2017, the board elected one new director, Mr. Shipp, in accordance with an agreement between Olin and The Dow Chemical Company (Dow), now known as DowDupont, in connection with our acquisition of certain lines of business from Dow on October 5, 2015. Virginia law and Olin’s Bylaws require that any director elected by the board of directors (rather than the shareholders) serve only until the earlier ofending at the next election of directors byannual meeting (in this case, the shareholders2024 annual meeting) and until his or her successor is elected or until his or her earlier death, resignation or removal. The board

Our Board has nominated Mr. BogusBeverley A. Babcock, C. Robert Bunch, Matthew S. Darnall, Earl L. Shipp, Scott M. Sutton, William H. Weideman, W. Anthony Will and Carol A. Williams to serve as directors for a Class II director with aone-year term expiring in 2020 and Ms. Williams and Messrs. Shipp and Smith as Class III directors with terms expiring in 2021. The boardat our 2024 annual meeting.

Our Board expects that all of the nominees

recommended by it will be able to serve as directors. If any nominee is unable to accept election, a proxy voting in favor of such nominee will be voted for the election of a substitute nominee selected by

the board,our Board, unless

the boardour Board reduces the number of directors.

The board of directors

Our Board recommends a vote FOR the election of Mr. BogusBeverley A. Babcock, C. Robert Bunch, Matthew S. Darnall, Earl L. Shipp, Scott M. Sutton, William H. Weideman, W. Anthony Will and Carol A. Williams as directors.

Heidi S. Alderman, age 63, who has served as a

Class II director and Ms. Williams and Messrs. Shipp and Smith as Class III directors.member of our Board since 2019, will retire from our Board following the completion of her current term. As a result, our Board will be reduced to eight members on the date of the annual meeting. Proxies cannot be voted for a greater number of individuals than the number of nominees.

How many votes are required to elect a director?

A nominee will be elected as a director by a majority of the votes cast. A majority of the votes cast means that the number of votes FOR a nominee must exceed the number of votes AGAINST that nominee. Abstentions and

broker shares

held in street name that are not voted in the election of directors

(broker non-votes) will not be included in determining the number of votes cast and will not affect the outcome of the vote in the election of directors.

Business ExperienceProxy Statement Table of NomineesContents | | |

| Director Nominee Composition, Skills and Experience Matrix |

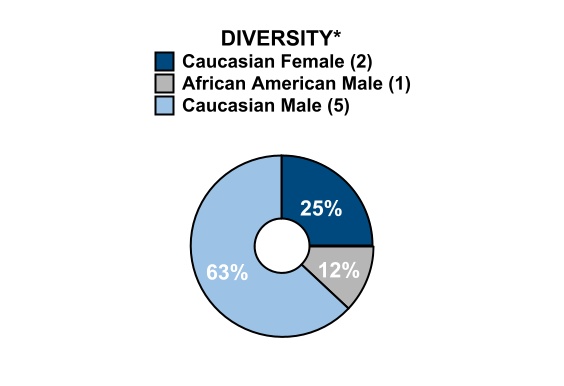

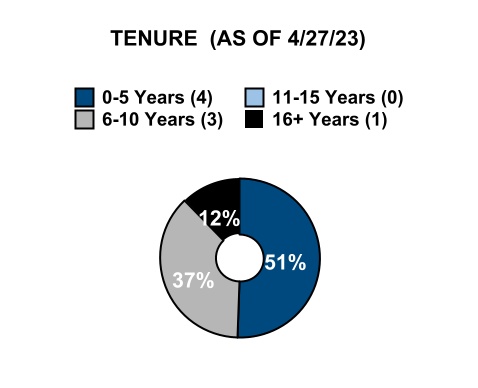

Our Nominating and Governance Committee, and our full Board, periodically review the experience and skills that they believe are desirable to be represented on our Board in the context of the current Board composition, and that otherwise align with our businesses and operations. Below is a summary of the composition of our director nominees (who have an average tenure on Olin’s Board of 6.3 years), followed by a summary of the significant experience and skills possessed by our director nominees.

| | | | | | | | | | | | | | | | | |

| Limited skill / experience | | Some skill / experience | | Very skilled / experienced |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Senior Leadership Experience (CEO, President or other C-Suite Role) | 12% | 12% | 76% |

| Significant experience leading and operating in large, complex businesses, including developing, implementing and assessing business plans and strategies | | | | | | | | | | |

| | | | | | | | | | |

| Global Business Experience | 25% | 75% |

| Significant experience developing and managing business in markets around the World and/or as part of a global business leadership team | | | | | | | | | | |

| | | | | | | | | | |

| Financial Experience | 25% | 75% |

| Significant experience making capital decisions, reviewing and analyzing financial information and reports, understanding financial markets and investment decision-making | | | | | | | | | | |

| | | | | | | | | | |

| Risk Management Experience | 62% | 38% |

| Significant experience identifying, prioritizing and managing risks, including strategic, operational, compliance, cyber-security, and environmental, health and safety | | | | | | | | | | |

| | | | | | | | | | |

| Corporate Governance / Public Company Experience | 12% | 25% | 63% |

| Significant experience with corporate governance planning, management accountability, ESG implementation, reporting obligations and regulatory compliance | | | | | | | | | | |

| | | | | | | | | | |

| Operations / Technology Experience | 25% | 38% | 38% |

| Significant experience in complex manufacturing, engineering, logistics and/or chemical operations, EHS requirements, driving productivity initiatives and information technology solutions | | | | | | | | | | |

| | | | | | | | | | |

| Commodity / Cyclical Business Experience | 12% | 25% | 63% |

| Significant experience in managing commodity or cyclical businesses | | | | | | | | | | |

| | | | | | | | | | |

| Marketing / Sales Experience | 38% | 63% |

| Significant experience enhancing sales into existing markets and developing new markets and products | | | | | | | | | | |

| | | | | | | | | | |

| Corporate Development / Strategic Planning Experience | 63% | 38% |

| Significant experience with implementing and reviewing strategic plans and processes, including acquisitions, divestitures, joint ventures and other opportunities | | | | | | | | | | |

| | | | | | | | | | |

| Human Capital / Executive Compensation / Talent Management Experience | 50% | 50% |

| Significant experience with executive development, performance and compensation planning and analysis, human capital management and ESG social elements | | | | | | | | | | |

*Based on self-identified demographic information provided by the director nominees.

| | |

| Business Experience of Nominees |

Set forth on the following pages are descriptions of the business experience of each director nominee, including a brief summary of the specific experience, qualifications, attributes and skills that led our boardBoard to conclude that these individuals should serve as our directors.Ages are reflected as of the date of our annual meeting (April 27, 2023).

CLASS II

NOMINEENOMINEES FORTWO-YEAR TERM ONE YEAR TERMS EXPIRING IN 2020

2024 | | | | | |

| | DONALD W. BOGUS, 71, retired in January 2009, from his positions as

Beverley A. Babcock Director Since: June 2019 Independent Age: 62

•Olin Committees: Chair of the Audit Committee; Member of the Executive Committee •‘Audit Committee Financial Expert’ under applicable SEC rules •Former Chief Financial Officer and Senior Vice President, Finance and Administration and Controller of The LubrizolImperial Oil Limited •Former Assistant Controller and Vice President, Corporate Financial Services of ExxonMobil Corporation now •Former Member of NYSE Listed Company Advisory Board •Member of the Chartered Professional Accountants of Canada Ms. Babcock brings a subsidiarycombination of Berkshire Hathaway (NYSE: BRK.A;extensive global financial, accounting and treasury management expertise, and relevant industry experience to the Olin’s Board. |

| Ms. Babcock retired in May 2018 as Chief Financial Officer and Senior Vice President, Finance and Administration and Controller of Imperial Oil Limited, a global supplier of high performance specialty products for personal care, coatings, plastics, and various industrial products) and President of Lubrizol Advanced Materials, Inc.,publicly-held Canadian petroleum company with 69.6% ownership by ExxonMobil Corporation, a wholly-owned subsidiary of The Lubrizol Corporation, positions heposition she held since June 2004. September 2015. Prior to that, Ms. Babcock served as Vice President, Corporate Financial Services from 2013 to 2015, Assistant Controller, Corporate Accounting Services from 2011 to 2013, and in various other senior leadership positions from 1998 to 2013, all at ExxonMobil Corporation. Earlier in her career, she was an Auditor of Clarkson Gordon, which became part of Ernst & Young. Ms. Babcock is a former member of the NYSE Listed Company Advisory Board and is a member of the Chartered Professional Accountants of Canada.

Ms. Babcock serves on the Board of Directors of Forté Foundation and Westinghouse Air Brake Technologies Corporation.

Ms. Babcock earned a bachelor’s degree from Queen’s University and a master’s degree in business administration from McMaster University. |

| |

| | | | | |

| C. Robert Bunch Director Since: December 2005 Independent Age: 68 •Olin Committees: Chair of the Compensation Committee; Member of the Executive Committee •Former Chairman of the Board and Chief Executive Officer of Global Tubing •Former Chairman, President and Chief Executive Officer of Maverick Tube Corporation Mr. Bogus joined LubrizolBunch brings extensive corporate governance, executive leadership, and business strategy experience to Olin’s Board.

Mr. Bunch most recently served as Chairman of the Board and Chief Executive Officer of Global Tubing, LLC, a privately held company which manufactured and sold coiled tubing and related products and services to the energy industry. Previously, he served as Chairman, President and CEO of Maverick Tube Corporation, a producer of welded tubular steel products used in April 2000,energy and industrial applications. Mr. Bunch served on the Board of Directors of Pioneer Drilling Company from May 2004 until August 2008. He began his career at Input/Output in 1999 as Vice President and his duties included responsibility for the Fluid Technologies for Industry business section and he served as the head of mergers and acquisitions. Prior to joining Lubrizol, he was an ExecutiveChief Administrative Officer, at PPG Industries, Inc. (a manufacturer of coatings and glass products) where he served as Vicelater became President and Chief Operating Officer from 2002 to 2003. He was also an independent oil service consultant.

Mr. Bunch serves on the Board of Specialty Chemicals and Vice PresidentTrustees of Industrial Coatings. Awty International School.

Mr. BogusBunch earned a bachelor’s degree in biologyeconomics and chemistrya master’s degree in accounting from Baldwin Wallace University. He serves on the board of trustees for Baldwin WallaceRice University and on their Business Division’s advisory board. a juris doctorate degree from the University of Houston. |

| |

| Matthew S. Darnall Director Since: September 2021 Independent Age: 60

•Olin director since July 2005; member of the CompensationCommittees: Audit Committee and Nominating and Governance Committee •Former Managing Director, Industrials Group of The Goldman Sachs Group, Inc.

Mr. Darnall brings significant investment banker expertise and merger and acquisitions, capital structure and allocation, and corporate structure and reorganization experience to Olin’s Board of Directors.

Mr. Darnall retired in July 2021 from his position as Managing Director, Industrials Group of The Goldman Sachs Group, Inc. (a financial institution), a position he held since 2003. Over a 36-year career at The Goldman Sachs Group, Mr. Darnall advised companies on corporate financial matters and merger transactions within the DirectorsCommunications, Media and Corporate Governance Committee. Mr. Bogus’ executive management positions have provided him with expertiseEntertainment Group from 1994 to 2003; Energy and Power Group from 1990 to 1994; Midwest Regional Coverage Group from 1988 to 1990 and as an Analyst in the chemicals industry, as well as mergerMergers and acquisition experience.Acquisitions Group from 1985 to 1988.

Mr. Darnall earned a bachelor’s degree in economics from DePauw University and a master’s degree in business administration from the University of Chicago. |

| |

| |

CLASS III

NOMINEES FOR THREE-YEAR TERMS EXPIRING IN 2021

| | | | | |

| | EARL

Earl L. SHIPP, 60,Shipp Director Since: October 2017 Independent Age: 65

•Olin Committees: Audit Committee and Compensation Committee •Former Vice President, US Gulf Coast Operations of The Dow Chemical Company •Former President, Dow Africa and Former President, Basic Chemicals Group of Dow •Director of National Grid plc and Great Lakes Dredge & Dock Co. •NACD Cyber Security Oversight Certified

Mr. Shipp brings substantial chemical industry expertise, and manufacturing, engineering and operations management experience to Olin’s Board. Mr. Shipp retired in September 2017 from his position as Vice President, US Gulf Coast Operations of The Dow Chemical Company, now known as DowDupont (NYSE: DWDP; a diversified chemical manufacturing company),company, a position he held since November 2010. Prior to that, Mr. Shipphe served as President—President of Dow Africa from June 2009 to October 2010 and President—as President of Basic Chemicals Group at Dow from May 2007 to May 2009. During his 36 years36-year history at Dow, he held a variety of leadership and engineering roles, including appointments as Site Director of Louisiana Operations and Global Operations Director for Propylene Oxide/Propylene Glycol, in 2000, Business Director for Propylene Oxide/Propylene Glycol, in February 2004, Business Vice President for Oxides and Glycols, in July 2005 and Business Vice President—Ethylene Oxide and Ethylene Glycol and President—India, Middle East and Africa Region in February 2006. Region.

Mr. Shipp serves on the Board of Directors of National Grid plc, and is chair of its Board’s Safety & Sustainability Committee and a member of its Board’s People & Governance Committee.He also serves on the Board of Directors of Great Lakes Dredge & Dock Co. and is a member of that Board’s Audit Committee.Mr. Shipp also is on the Board of Directors of various not-for-profit organizations, including CHI St. Luke’s Health - Texas Division and The Economic Development Alliance of Brazoria County, Texas.

Mr. Shipp earned a bachelor’s degree in chemical engineering from Wayne State University and completed the executive education program at Indiana State University School of Business. He is on the board of directors of CHI St. Luke’s Health, Brazoria Fort Bend Rail District and The Economic Development Alliance of Brazoria County, Texas. Olin director since October 2017; member of the Audit Committee and the Directors and Corporate Governance Committee. Mr. Shipp’s extensive management expertise in manufacturing and operations provides him with valuable knowledge of the chemical industry. |

| | |

| | VINCENT J. SMITH, 68, retired in 2004, from his position as

Scott M. Sutton Director Since: September 2018 Chairman, President and Chief Executive Officer Age: 58 •Olin Committees: Chair of the Executive Committee •President and Chief Executive Officer of Dow Chemical Canada, a subsidiary of The Dow Chemical Company, now known as DowDupont (NYSE: DWDP; a diversified chemical manufacturing company), a position he held from 2001. From 1972 to 2000, he held positions of increasing responsibility in engineering, manufacturing and management, including the position of Business Director for Dow’s global chlor-alkali assets. Mr. Smith earned a bachelor’s degree in chemical engineering from McMaster University. Olin director since August 2008; member of the Compensation Committee and the Directors and Corporate Governance Committee. Mr. Smith’s executive service has provided him with valuable international and manufacturing experience, together with extensive knowledge of the chlor alkali industry. |

| | CAROL A. WILLIAMS, 59, retired in early 2015, from her position as special advisor to theCorporation

•Former Chief Executive Officer and Director of The Dow Chemical Company, now known as DowDupont (NYSE: DWDP; a diversified chemical manufacturing company). Prior to her special advisor role, she served as Dow’s Executive Vice President of Manufacturing and Engineering, Supply Chain and Environmental, Health & Safety Operations. During Ms. Williams’ 34 year history at Dow, she assumed increasingly more significant management positions in research and development before becoming operations leader and then Vice President for the global chlor-alkali assets business. She was named Senior Vice President of Basic Chemicals in 2009 and President of Chemicals & Energy in 2010. Ms. Williams earned a bachelor’s degree in chemical engineering from Carnegie Mellon University. She is the independent board chair and serves on the board of directors and the nominating/governance committee of Owens-Illinois Inc. (a leading producer of high quality glass packaging). Ms. Williams is also a member of the Engineering Advisory Board and Energy Futures Institute Presidential Consultation Committee for Carnegie Mellon University. From 2012 through June 2015, she was on the board of directors of Zep, Inc. (a supplier of industrial cleaning materials). Olin director since October 2015; member of the Compensation Committee and the Directors and Corporate Governance Committee. Ms. Williams’ extensive management expertise from manufacturing to purchasing to supply chain as well as her substantial experience in research and development provides her with valuable knowledge of the chemicals industry. |

Business Experience of Continuing Directors

Set forth on the following pages are descriptions of the business experience of each continuing director. The terms of the following directors will continue after the 2018 annual meeting, as indicated below.

CLASS I

DIRECTORS WHOSE TERMS CONTINUE UNTIL 2019

| | |

| | C. ROBERT BUNCH, 63, served as Chairman of the Board and Chief Executive Officer of Global Tubing, LLC (a privately held company formed in April 2007, to manufacture and sell coiled tubing and related products and services to the energy industry which was acquired by Forum Energy Technologies, Inc. (NYSE: FET) and Quantum Energy Partners in July 2013) from May 2007 until June 2013. Mr. Bunch served as Chairman of Maverick TubePrince International Corporation (a producer of welded tubular steel products used in energy and industrial applications which was acquired by Tenaris, S.A. in October 2006) from January 2005 until October 2006, and as President and Chief Executive Officer from October 2004 until October 2006. Prior to joining Maverick, he was an independent oil service consultant from 2003 until 2004, and from 2002 to 2003, he served as President and

•Former Chief Operating Officer at Input/Output, Inc. (an independent provider of seismic imaging technologies and digital, full-wave imaging solutions for the oil and gas industry). From 1999 to 2002, he served as ViceCelanese Corporation •Former President and Chief Administrative OfficerGeneral Manager of Input/Output, Inc. AgroSolutions at Chemtura Corporation

Mr. Bunch earned a bachelor’s degree in economics and a master’s degree in accounting from Rice University and a juris doctorate degree from the University of Houston. From May 2004 until August 2008, Mr. Bunch served on the board of directors (and as Chairman from January 2007 to August 2008) of Pioneer Drilling Company (a provider of land contract drilling services to independent and major oil and gas exploration and production companies). Olin director since December 2005; member of the Compensation Committee and the Directors and Corporate Governance Committee. Mr. Bunch’s broad management responsibilities provide relevantSutton brings extensive experience in a numberoperations, engineering, manufacturing, finance, sales, marketing, and management of strategic and operational areas. |

| |

| | RANDALL W. LARRIMORE, 70, served ascomplex businesses with worldwide operations to Olin’s Board.

Mr. Sutton became Chairman, of Olin from April 2003 through June 2005. From 1997 until his retirement in December 2002, he served as President and Chief Executive Officer of United Stationers Inc., now knownOlin Corporation on April 22, 2021, after serving as Essendant (NASDAQ: ESND; a wholesaler/distributor of business products). From 1988 until 1997, he wasOlin’s President and Chief Executive Officer of MasterBrand Industries, Inc., now known as Fortune Brands Home & Security LLC (NYSE: FBHS; a consumer products company). He holds a bachelor’s degree from Swarthmore College with a major in economics and a minor in chemistry and a master’s degree in business administration from Harvard Business School. He isco-chair of the governance committee and a member of the board of directors and compensation committee of Campbell Soup Company (a manufacturer and marketer of soup and other food products), and a member of the board of directors of Nixon Uniform Service and Medical Wear (a privately held company that provides, launders, and delivers medical apparel, linens, and other reusable products, primarilysince September 2020. From December 2019 to healthcare providers) and Chesapeake Conservancy (anon-profit organization to protect and restore the Chesapeake Bay). He was also a Captain in the U.S. Army Reserves. Olin director since January 1998; Chair of the Directors and Corporate Governance Committee and a member of the Audit Committee, the Compensation Committee and the Executive Committee. Mr. Larrimore brings expertise in marketing, sales, strategic planning, mergers and acquisitions and general management.

|

| | |

| | JOHN M. B. O’CONNOR, 63, is Chairman and Chief Executive Officer of J.H. Whitney Investment Management, LLC (an alternative investment firm), a position he has held since January 2005 and Chief Executive Officer of Whitney Strategic Services, LLC (a provider of global economic advisory services to the US Department of Defense). From January 2009 through March 2011,July 2020, he served as Chief Executive Officer of Tactronics Holdings, LLC (a Whitney Capital Partners portfolio holding company that provided tactical integrated electronic systems to U.S. and foreign military customers as well as the composite armor solutions for military vehicles through its Armostruxx division). Previously, Mr. O’Connor was Chairman of JP Morgan Alternative Asset Management, Inc. (part of the investment manager arm of JP Morgan) and an Executive Partner of JP Morgan Partners (a private equity firm). He was also a member of the Risk Management CommitteeBoard of JP Morgan Chase, which was responsibleDirectors of Prince International Corporation, a privately held specialty chemicals company. From August 2013 to February 2019, he served in a variety of roles of increasing responsibility at Celanese Corporation, a global chemical and specialty materials company, including Chief Operating Officer, Executive Vice President and President, Materials Solutions, and Vice President and General Manager, Engineered Materials. Earlier in his career, Mr. Sutton served as President and General Manager of Chemtura Corporation’s AgroSolutions business, business manager for policy formulationLandmark Structures and oversight of all market and credit risk taking activities globally. a division vice president for Albemarle Corporation.

Mr. O’ConnorSutton earned a bachelor’s degree in economicscivil engineering from TulaneLouisiana State University and a master’s degree in business administration from Columbia University Graduate School of Business. Mr. O’Connor is a member of the board of directors at IntegriCo Composites, Inc. (a privately held specialized composite products manufacturer). He also serves on the advisory boards of American Friends of the Clock Tower Fund, Cornell University College of Veterinary Medicine, Game Conservancy USA and UK Game Conservancy and Wildlife Trust, Grayson-Jockey Club Research Foundation, Global Guardian, LLC and New York Green Bank. Mr. O’Connor serves as a member of the Department of Defense Business Board and as the Civilian Aide to the Secretary of the Army (CASA) for New York (South). registered professional engineer in Texas. |

| | | | | |

| William H. Weideman Director Since: October 2015 Independent Age: 68

•Olin director since January 2006; memberCommittees: Lead Director; Member of the Audit Committee and Executive Committee •‘Audit Committee Financial Expert’ under applicable SEC rules •Former Chief Financial Officer and Executive Vice President of The Dow Chemical Company •Former Director of Dow Chemical Employees’ Credit Union, Mid-Michigan Medical Center and Sadara Chemical Company Mr. Weideman brings valuable financial, audit, and business administration expertise to Olin’s Board, as well as extensive knowledge of the Directors and Corporate Governance Committee. businesses Olin acquired from The Dow Chemical Company.

Mr. O’Connor’s hedge fund and investment banking experience allow him to contribute broad financial and global expertise. |

| |

| | WILLIAM H. WEIDEMAN, 63,Weideman retired in January 2015 from his position as Chief Financial Officer and Executive Vice President of The Dow Chemical Company, now known as DowDupont (NYSE: DWDP; a diversified chemical manufacturing company),company, a position he held since March 2010. Prior to that, Mr. Weideman served as an Interim Chief Financial Officer from November 2009 to March 2010, and Executive Vice President of Finance, Dow Agrosciences & Corporate Strategic Development from April 2010 to September 2012, all at Dow. He joined Dow in 1976 as a Cost Accountant in Midland, Michigan and held a variety of accounting and controller roles for different Dow businesses. Olin’s board of directors has determined that

Mr. Weideman qualifies as an “audit committee financial expert”served on the Board of Directors of Mid-Michigan Medical Center and on the Board of Trustees for Olin under applicable SEC rules. Central Michigan University through December 31, 2020. From October 30, 2011 through December 2015, he served on the Board of Directors of Sadara Chemical Company, a joint venture between Saudi Aramco and Dow. From August 30, 2000 through December 2015, he was on the Board of Directors of the Dow Chemical Employees’ Credit Union.

Mr. Weideman earned a bachelor’s degree in business administration and accounting from Central Michigan University. He is a director

|

| |

| W. Anthony Will Director Since: September 2021 Independent Age: 57

•Olin Committees: Compensation Committee and Nominating and Governance Committee •President and Chief Executive Officer and Director of theMid-Michigan Medical CenterCF Industries Holdings Inc.

Mr. Will brings significant public company chief executive officer, operations and is on the boardcorporate development expertise and risk management, accounting and finance and human capital management experience to Olin’s Board of trustees for Central Michigan University. From October 30, 2011 until December 31, 2015, he servedDirectors.

Mr. Will serves as a director of Sadara Chemical Company (a joint venture between Saudi AramcoPresident and Dow) and from August 30, 2000 until December 31, 2015, he was a director of the Dow Chemical Employees’ Credit Union. Olin director since October 2015; Chair of the Audit CommitteeChief Executive Officer and a member of the Board of Directors of CF Industries Holdings Inc. (a leading global manufacturer of hydrogen and Corporate Governance Committee and Executive Committee. Mr. Weideman’s extensive history with Dow provides him with valuable financial and business administration expertise. |

CLASS II

DIRECTORS WHOSE TERMS CONTINUE UNTIL 2020

| | |

| | GRAY G. BENOIST, 65, retired in March 2012, from his position as an officer on special assignment of Belden, Inc. (NYSE: BDC; a designer, manufacturer and marketer of signal transmission solutions, including cable, connectivity and active components for mission-critical applications in markets ranging from industrial automation to data centers, broadcast studios, and aerospace)nitrogen products), a positionpositions he has held since January 1, 2012. From August 2006 until January 1, 2012,2014. Prior to that, he served as Senior Vice President, FinanceManufacturing and Chief Financial Officer of Belden andDistribution from November 2009 until January 2012 he alsoto January 2014; Vice President, Manufacturing and Distribution from March 2009 to December 2011 and Vice President, Corporate Development from April 2007 to March 2009. Mr. Will served in comparable officer positions with Terra Nitrogen GP Inc. (an indirect, wholly-owned subsidiary and the sole general partner of Terra Nitrogen Company, L.P. until purchased by CF Industries in April 2018) and as a member of its board of directors from June 2010 until February 2016 and as chairman of the Board from January 2014 to February 2016. Earlier in his career, Mr. Will served as Chief Accounting Officera partner at Accenture Ltd., vice president, business development at Sears, Roebuck and prior to that, as Senior Vice President, Director of Finance of the Networks Segment of Motorola Inc. (a business unit responsibleCompany, consultant for the global design, manufacturing,Egon Zehnder International, vice president, strategy and distribution of wireless and wired telecom system solutions). During more than 25 years with Motorola, Mr. Benoist served in senior financial and general management roles across Motorola’s portfolio of businesses, including the Personal Communications Sector, Integrated and Electronic Systems Sector, Multimedia Group, Wireless Datacorporate development at Fort James Corporation, manager at Boston Consulting Group and Cellular Infrastructure Group. He hasgroup leader at Motorola Solutions, Inc.

|

| | | | | |

| Mr. Will earned a bachelor’s degree in finance and accountingelectrical engineering from Southern IllinoisIowa State University and a master’s degree in business administration from the University of Chicago. Mr. Benoist serves on the board of directors of Neurowrx, Inc. (anot-for-profit organization in Canada with the mission of accelerating global STEM employment for autistic individuals). He is also President and Treasurer of MindSpark, Inc. (a registered benefit corporation in California delivering software testing services through the employment of adults with autism spectrum disorder). Olin director since February 2009; member of the Audit Committee and the Directors and Corporate Governance Committee. Mr. Benoist’s chief financial officer experience provides him with valuable financial and accounting expertise.Northwestern University. |

| |

| | JOHN E. FISCHER, 62, became Chairman,

Carol A. Williams Director Since: October 2015 Independent Age: 65 •Olin Committees: Chair of the Nominating and Governance Committee; Member of the Executive Committee •Former Executive Vice President, Manufacturing and Engineering, Supply Chain and Environmental, Health & Safety Operations of The Dow Chemical Company •Former Vice President, Chlor-alkali Assets Business of Dow, and Senior Vice President of Basic Chemicals •Director of O-I Glass, Inc.

Ms. Williams brings extensive management expertise in manufacturing, purchasing and supply chain operations, substantial experience in research and development, and comprehensive knowledge of the chlor-alkali and general chemicals industry to Olin’s Board.

Ms. Williams retired in 2015 as Special Advisor to the Chief Executive Officer of Olin on April 27, 2017. HeThe Dow Chemical Company, a diversified chemical manufacturing company, a position she held the positionssince January 2015. Prior to this, she served as Dow’s Executive Vice President of Manufacturing and Engineering from September 2011 to December 2014, adding responsibility for Supply Chain and Environmental, Health & Safety Operations in 2012, President and Chief Executive Officer since May 1, 2016, President and Chief Operating Officerof Chemicals & Energy from May 2014 until April 30, 2016,August 2010 to August 2011, and Senior Vice President of Basic Chemicals from January 2009 to July 2010, all at Dow. During Ms. Williams’ 34-year history at Dow, she assumed increasingly more significant management positions in research and Chief Financial Officer from October 2010 untildevelopment before becoming operations leader and then Vice President for the global chlor-alkali assets business.

Ms. Williams joined the Board of Directors of O-I Glass, Inc. in May 2014 Vice President and Chief Financial Officer from May 2005 to October 2010, Vice President, Financecurrently serves on its Nominating/Corporate Governance Committee and Controller from June 2004 until May 2005, after rejoining Olin in early 2004. From 2002 through 2003, heCompensation and Talent Management Committee.She served as an independent financial consultantits Independent Board Chair from 2015 to Olin2021. Ms. Williams is a member of the Engineering Advisory Board and other unaffiliated companies. From 1996Energy Futures Institute Presidential Consultation Committee for Carnegie Mellon University. She was on the Board of Directors of Zep, Inc. from 2012 through 2001, he directed all financial functions, acquisitions and divestments for Primex Technologies, Inc. (a munitions, propellants, satellite propulsion systems and electronic products manufacturing company spun off from Olin in 1996 and is now called General Dynamics Ordnance and Tactical Systems). Prior to this, Mr. Fischer was Vice President and Financial Officer for Olin’s Ordnance division where he supervised all division financial reporting and planning and government contract management. He began his career with General Defense Corporation in 1977, serving in various accounting and cost accounting positions prior to being appointed Controller in 1985. Mr. FischerJune 2015.

Ms. Williams earned a bachelor’s degree in accounting and economicschemical engineering from Franklin and Marshall College and a master’s degree in finance from Pennsylvania StateCarnegie Mellon University. Mr. Fischer’s extensive financial and executive management experience, deep knowledge of Olin and extensive involvement in the transaction of the acquired businesses from Dow, now known as DowDupont, and his leading the integration provide valuable expertise. |

CORPORATE GOVERNANCE MATTERS

| | |

| How Many Meetings Did Board Members Attend? |

During 2022, our Board

Members Attend?

During 2017, the board held eightsix meetings. As part of each regularly scheduled boardBoard meeting, thenon-employee directors met in executive session. In 2017, all directorssession without management present. Overall attendance at Board and Board Committee meetings was 94%. Each incumbent director attended over 94%at least 75% of the aggregate total number of meetings ofheld by the boardBoard and committees of the board on which they served. In addition, each director attended over 89% of the meetings of the board and committees of the boardall Board Committees on which he or she served during their period of service.served. We have a policy requiring directors to attend each annual meeting, absent serious extenuating circumstances. All of our directors attended the 2017 annual meeting. Our policy regarding directors’ attendancewho were members of our Board at the time of our 2022 annual meeting is that they are required to attend, absent serious extenuating circumstances.

participated in our 2022 annual meeting.

| | |

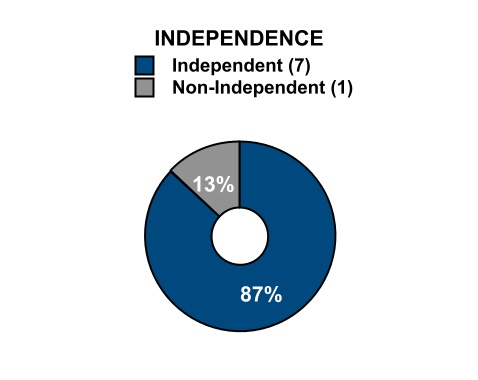

| Which Board Members Are Independent? |

Our Board

Members Are Independent?

Our board has determined that alleach of its members,the director nominees named above, except Mr. Fischer, areScott M. Sutton, is independent in accordance with applicable New York Stock Exchange (NYSE) listing standards and applicable provisions of our Principles of Corporate Governance. Additionally, our Board determined that Ms. Alderman, who is not standing for re-election at the 2023 annual meeting, is also independent in accordance with applicable NYSE listing standards and applicable provisions of our Principals of Corporate Governance. In determining independence, the boardour Board confirms that a director has no relationship with Olin that violates the “bright line” independence standards under the NYSE listing standards. The boardOur Board also reviews whether a director has any other material relationship with Olin, after consideration of